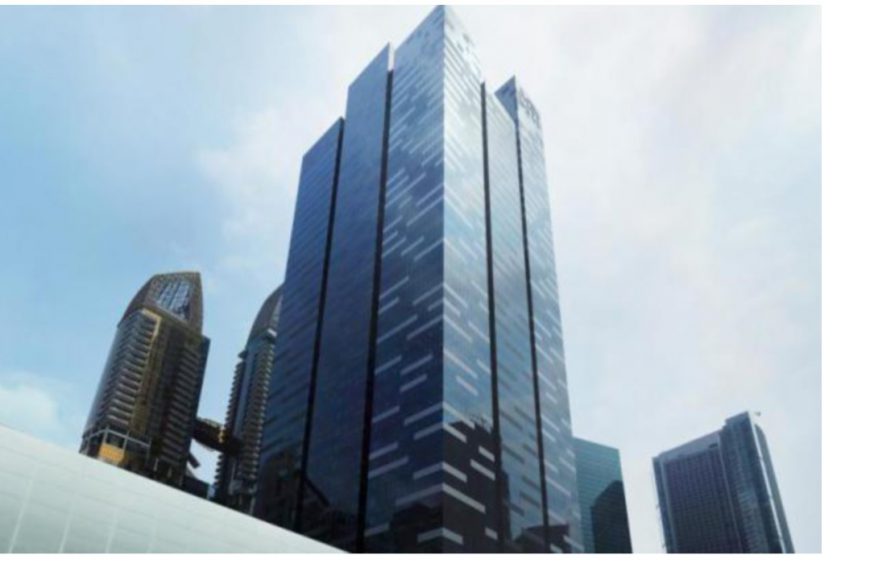

ASSET management giant BlackRock has put up Asia Square Tower 1 for sale. The price tag is said to be about S$4 billion for the 43-storey tower, which would work out to around S$3,200 per square foot of net lettable area.

Tower 1 has 1.2 million square feet of offices and about 40,000 sq ft of retail space.

BlackRock is said to have appointed CBRE and JLL as marketing agents for the sale of Tower 1. The two are expected to conduct an expression of interest exercise, with a sale scheduled to be concluded by the year-end.

Market watchers suggest that while the initial mandate given by BlackRock is for the sale of Tower 1, the group is also open to divesting the rest of the space it owns in the Asia Square development – that is, about 750,000 sq ft of offices and 30,000 sq ft of retail space in Tower 2.

Based on the same S$3,200 psf pricing, BlackRock’s Tower 2 space would be worth S$2.5 billion – resulting in a total sum of S$6.5 billion for the group’s space in the entire development.

Asia Square Tower 2 also houses The Westin Singapore, which sits on Levels 32 and upwards of the 46-storey building. In late 2013, BlackRock sold the hotel to Japan’s Daisho Group for S$468 million or S$1.5 million per room.

Offices fill Levels 6-31 of Asia Square Tower 2, while the first two levels have retail space.

Tower 1 has offices on Levels 6-43 and retail space on Levels 1-2. Both towers have car parking lots on Levels 3-5.

Citi, Julius Baer, Google and Marsh are among the tenants in Tower 1.

Both towers are held by the same BlackRock-managed fund.

MGPA, which was acquired by BlackRock in 2013, developed Asia Square on two 99-year leasehold sites that it clinched at separate Urban Redevelopment Authority tenders in 2007.

“Asia Square is a trophy Grade-A office building in Singapore which BlackRock Real Estate has developed from a bare piece of land and leased to an excellent tenant base,” said BlackRock’s spokesman.

“The nature of this asset is that it regularly attracts attention and we continually assess the market for the best outcomes for our tenants and investors; we remain open to all options that satisfy these interests. We remain positive on the Singapore office market.”

Market watchers, however, note that the Asia Square development has existing office vacancy, which is expected to increase when a few existing tenants move out.

In Tower 1, Google is expected to give up the 130,000 sq ft that it occupies under a lease that expires in late 2016. The tech giant is heading to Mapletree Business City II in the Pasir Panjang/Alexandra Terrace area.

Another tenant, Lloyd’s Asia, will be vacating about 65,000 sq ft at Asia Square Tower 1 to move to CapitaGreen, based on an earlier media report.

In January this year, another BlackRock-managed fund sold Axa Tower, a 50-storey circular office building opposite Tanjong Pagar MRT Station, for S$1.17 billion to a consortium of investors syndicated by Perennial Real Estate Holdings.

The price worked out to S$1,735 psf of net lettable area; at the time, the AXA Tower site had a remaining lease term of about 66.5 years.

Source: The Business Time, 9 June 2015