RENTS for business parks in Singapore’s city fringe are projected to rise as more firms seek out business parks with Grade-A office specifications in a bid to cut their real-estate costs.

In the third quarter of 2020, rents of business parks in the city fringe stood at S$5.91 per square foot per month (psf/month), up 0.2 per cent quarter on quarter and 2.4 per cent higher from a year ago, data from real estate services firm Cushman & Wakefield showed.

Christine Li, the company’s head of research for Singapore and South-east Asia, said another factor driving the move to business parks is the trend of companies with a large proportion of their employees working from home, thus lowering the need for central business district (CBD) office space.

She said: “The movement towards business parks with Grade-A specifications and the continued moderation of Grade-A CBD rents will further narrow the rental gap between CBD office and city-fringe business park space over the next few quarters.”

This trend is expected to reverse only after Grade-A CBD rents decline by a projected 20 per cent next year and become more affordable for occupiers again.

However, rents for business parks in the outlying areas will decline due to the older stock there, Cushman & Wakefield said.

In the third quarter, rents for business parks in outlying areas stood at S$3.64 psf/month.

Another “bright spot” for the industrial sector is the prime logistics segment.

Rents for the sector are expected to rise due to a strong preference for ramp-up facilities, Cushman & Wakefield noted. In the third quarter, prime logistics rents rose by 1.5 per cent on the quarter.

Science park facilities, which house a large cluster of pharmaceutical and biomedical firms, are expected to see rents increase slightly due to demand growth for products and research and development in the healthcare sector.

Rents for science park facilities stood at S$4.27 psf/month in Q3.

Meanwhile, high-tech rents may remain stable due to the growth of the electronics sector, said the report. In Q3, high-tech rents stood at S$3.12 psf/month.

Despite the hype in investor interest in logistics assets, the level of investment activity has been low.

The report noted that the number of inked deals is still lagging the broader economic challenges. Industrial assets were down 39 per cent to S$446.5 million in Q3 from the quarter before, and declined 89 per cent year on year.

Brenda Ong, Cushman & Wakefield executive director and head of logistics and industrial, said: “Long-term players in the logistics sector are reluctant to sell their assets, unless the investor is a fund with a fixed fund life.”

She added that there is no impetus for those with a long-term horizon to put their assets on the market, particularly when quality assets are few and far between. Investors are also bound by sale moratoriums as regulated by the authorities, she noted.

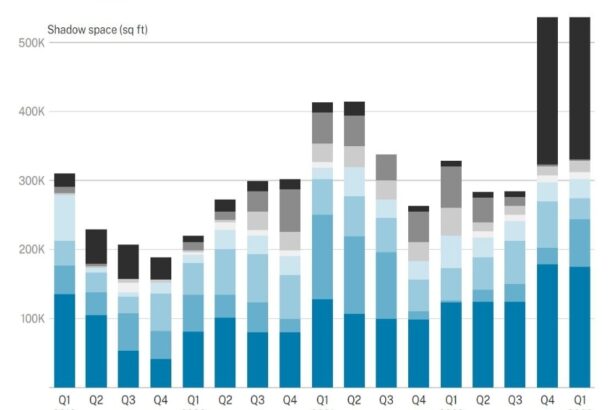

Nevertheless, the third quarter recorded some activity in the logistics sector, as demand for storage space “increased significantly” in recent times due to the government-led stockpiling of essential supplies to guard against future supply disruptions, Cushman & Wakefield said.

By Vivienne Tay, The Business Times/ 21-Oct-2020