ESPITE continued contraction in net office demand and rising vacancies, office rents continued to rise in the second quarter, based on the latest official data.

This has come about from improved leasing activity for spaces in newer, better-quality, more environmentally-friendly offices in attractive locations, amid a flight to quality by smaller occupiers – including some tech companies and investment/

The Urban Redevelopment Authority’s latest data shows that the median rental for Category 1 office buildings – covering the better-quality buildings in the city area – rose 1.1 per cent quarter on quarter in Q2 2021. On the other hand, the median rent for the remaining office space in Singapore – or Category 2 – slipped one per cent over the same period.

Knight Frank Singapore research head, Leonard Tay, said: “On the one hand, we continue to see footprint consolidation and rightsizing by some corporates including financial institutions due to work-from-home protocols and general business conditions.

“That said, office rents in good-quality buildings in choice locations in the CBD have started to stabilise.”

Tricia Song, head of research for Southeast Asia at CBRE, said the property consulting group’s Grade A (Core CBD) rents showed an increase of one per cent q-o-q to S$10.50 per square foot a month in Q2 2021, marking the first rental growth since Q4 2019.

“Encouraged by the fairly tight vacancy rate in the Grade A market, some landlords of better performing buildings have begun to push for higher rents as they benefit from the prevailing tightness. Conversely, the Grade B market struggled to backfill the existing vacant stock, and this placed further pressure on Grade B Core CBD rents,” said Ms Song.

She expects this two-tier market to continue, with the medium-term outlook for the Grade A office market looking positive, but with the recovery in the Grade B market likely to lag as landlords grapple with rising vacancy rates.

URA’s rental index for office space in Singapore’s central region rose 1.3 per cent q-o-q in the second quarter. This is a smaller increase compared with the 3.3 per cent q-o-q rise in the first quarter.

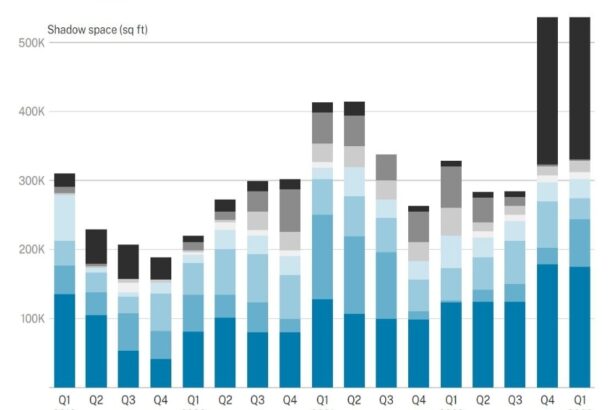

Islandwide net demand for office space, as measured by the change in occupied space, shrank by 247,570 sq ft in the second quarter, following the 204,514 sq ft contraction in the first quarter.

The bulk of the Q2 contraction in net absorption emanated from the Downtown Core (which includes the financial district), which saw negative net demand of 376,737 sq ft. This offset the 118,403 sq ft positive net absorption of office space recorded in the Fringe Area, noted Knight Frank’s Mr Tay.

Cushman & Wakefield’s Singapore research head, Wong Xian Yang, noted that in the first-half of this year, the Downtown Core offices have chalked up negative net demand of 689,000 sq ft. This contrasts with positive net demand of about 441,000 sq ft for the whole of last year. The figure in 2019, before the Covid outbreak, was positive 1.1 million sq ft.

The office vacancy rate in Downtown Core climbed for the third straight quarter to 12.8 per cent at end-Q2 2021 – from 11.0 per cent at end-Q1 2021, 10.3 per cent at end-Q4 2020 and 9.9 per cent at end-Q3 2020.

Most property consultants are upbeat about prospects for superior quality Grade A office space in well sought-after locations in the CBD.

On the whole, too, occupier demand for office space is expected to strengthen on the back of global economic recovery and Singapore’s reputation as a safe and conducive office location, says JLL Singapore’s head of research and consultancy, Tay Huey Ying. The recent rollback of the relaxation of Covid-19 measures in response to new infection clusters is unlikely to derail the office rental recovery, she adds.

“We are convinced that physical offices will remain the primary place of work as long as they undergo upgrades to meet the new priorities of workforce. This is supported by the findings of a recent JLL survey of employees based in Singapore that revealed the setting in of home-working fatigue,” Ms Tay said.

The survey found that “workers are craving face-to-face human interactions with colleagues and missing that change of scenery from working and living in different places”. The ideal number of days per week that employees would like to work from the office has risen from 1.7 days in the October 2020 survey, to 2.3 days in the March 2021 survey.

The URA’s price index for office space in the central region rose 0.9 per cent q-o-q in Q2 2021,contrasting with the 2.7 per cent drop in the previous quarter.

The Business Times