SINGAPORE Grade-A office rents in the Central Business District (CBD) could come under downward pressure in the second half of 2023, as near-term demand will likely fall short of supply, a JLL report showed.

While prime rents flattened in the second quarter and mostly stayed where they were in Q1, “landlords of buildings with large pockets of shadow space were starting to cave to the pressure by lowering rents to boost occupancies in the second quarter of 2023”, said Tay Huey Ying, JLL’s head of research and consultancy, Singapore.

Tricia Song, CBRE’s head of research for South-east Asia, saw certain groups of office occupiers “continue to face challenging business conditions”. Some tenants, such as those in technology, cryptocurrency and consumer banking, may be contemplating cutting office space, “potentially contributing to more shadow space in the second half of the year”.

Shadow space refers to the excess space on an existing lease obligation that a tenant would like to give up by finding a replacement tenant for the landlord, rather than terminating the lease and incurring penalties. While not technically included as current vacant space, shadow space can point to future vacancy.

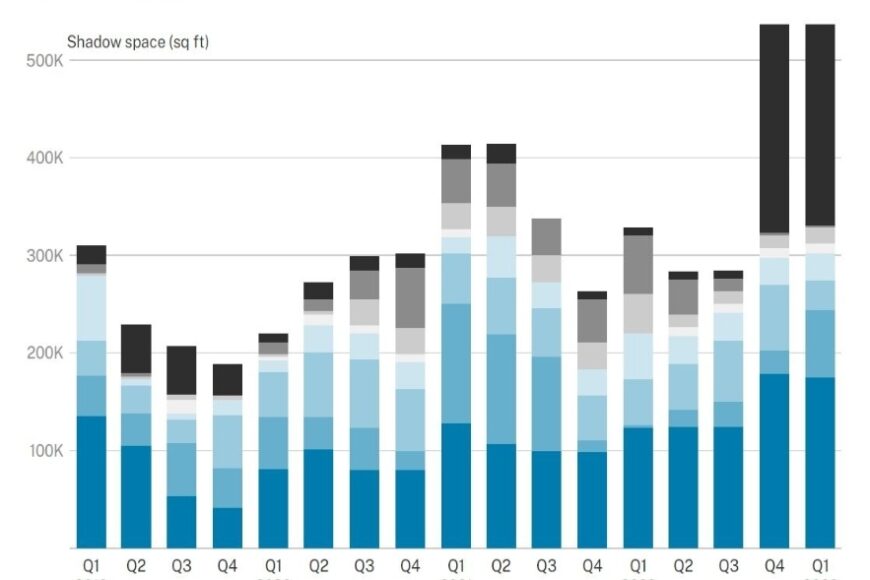

Although CBD supply is expected to remain tight, shadow space levels have begun to creep up, even as current vacancy hovers at around 4-4.5 per cent.

Savills Singapore estimates that about 2.1 per cent or 660,000 sq ft of its basket of Grade-A space in the Downtown Core consisted of shadow space in Q1. A separate Cushman & Wakefield report issued earlier this month reckoned that shadow space made for about 1 per cent of total office stock, and that about two-thirds of shadow space released in Q1 came from the tech sector.

By Jessie Lim, Business Times