THE slide in Singapore industrial property rents and prices continued in the third quarter, with the pace of decline gathering pace though occupancy improved, latest figures from JTC Corp show.

The industrial land and infrastructure agency said the rise in occupancy was driven by an increase in demand for storage amid a delay in new completions.

However, some property consultants offered another explanation for the rise in occupancy despite continuing rental declines.

Christine Li, head of research for Singapore and South-east Asia at Cushman and Wakefield, said: “This could mean that landlords were prioritising increasing occupancy at the expense of rental rates.”

The official prognosis for the sector sounds grim. Said JTC: “The rapidly evolving Covid-19 situation will continue to weigh on the industrial property market.

“There will be continued downward pressures on prices and rentals in the coming quarters, as well as construction delays for some projects. JTC will continue to monitor the market and support the needs of industrialists.”

JTC’s All Industrial rental index shed 0.9 per cent quarter on quarter in the third quarter of this year, after having slipped 0.7 per cent in Q2 and 0.1 per cent in Q1.

The latest index reading is also down 1.6 per cent year on year, and 15 per cent below the most recent peak in Q2 2014.

The All Industrial property price index eased 2.2 per cent q on q in the third quarter of this year, after falling 1.1 per cent in Q2 and 0.4 per cent in Q1.

The latest price index is also down 3.9 per cent year on year and 19.9 per cent below its peak in Q2 2014.

The vacancy rate eased to 10.4 per cent at end Q3, down 0.2 percentage point on a q-o-q basis; year on year, the decline was 0.3 percentage point.

JLL Singapore’s head of research and consultancy, Tay Huey Ying, noted that the net absorption of Singapore’s industrial space remained expansionary in Q3 2020.

“Demand was led by the warehouse sector, although the pace of expansion moderated from Q2 2020 – possibly due to a slowdown in new stockpiling and e-commerce requirements following the surge in the second quarter of this year,” she said.

“Notwithstanding the relatively healthy overall demand for industrial space, JTC’s All Industrial rent and price indices recorded their steepest q-o-q declines since 2017,” she added.

“This could be partly attributed to uneven performances. In general, newer and higher specifications spaces (such as ramp-up warehouses and select city-fringe business parks) are outperforming their older and conventional counterparts in occupancies and rents,” Ms Tay added.

CBRE’s head of research for South-east Asia, Desmond Sim, said that while the Covid-19 outbreak continued to exert downward pressure on the industrial property sector in Q3 2020, Singapore’s macro industrial indicators demonstrated “positive blips”.

“Manufacturing output rose by 13.7 per cent y-o-y in August 2020 and non-oil domestic exports edged up by 5.9 per cent y-o-y in September 2020, while the purchasing managers’ index expanded for the third consecutive month at 50.3 in September 2020.”

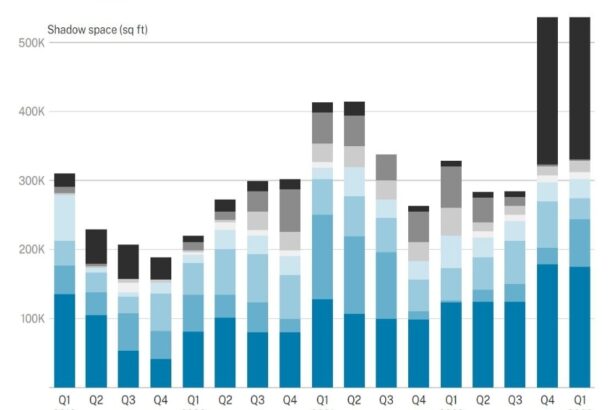

JTC said that in the third quarter, due to the impact of Covid-19 on the construction sector, only 24,000 sq m of new industrial space was completed, the lowest quarterly completion on record and a significant reduction from the average quarterly completion of around 270,000 sq m in the past three years.

What this means, said Ms Li of Cushman & Wakefield, is that for the whole of 2020, some 912,000 sq m of new supply is expected to be completed – similar to last year’s figure of 865,000 sq m.

According to JTC, an additional 700,000 sq m of new supply which was supposed to have been completed this year has been delayed to 2021 and 2022.

This was due to the impact of Covid-19, with the construction sector having to make adjustments to meet the Building and Construction Authority’s Safe Restart requirements, Ms Li noted.

This is expected to push up new-supply completion for next year to 2,158,000 sq m, followed by further completion of 1,476,000 sq m in 2022.

“The influx of supply in 2021 is larger than the previous supply peak of 1,941,000 sq m in 2017 and makes it unlikely that industrial rents will return to growth next year. Therefore, a further degree of rental moderation is to be expected in the short-term,” concluded Ms Li.

In similar vein, Ms Tay also said that most businesses are expected to stay cautious on their space requirements amid the cloudy economic outlook and geopolitical risks.

Colliers International’s Singapore research head, Tricia Song, while taking a generally cautious view on the Singapore industrial property market, points to some bright spots.

“Data centres and the high-spec segments could be more resilient as they benefit from the growing technology sector,” she said. “Warehouses could see some support from the rise in e-commerce driving demand for logistics services.”

“We expect a recovery in tandem with the general rebound in the economy in 2021 and beyond,” she added.

Putting things in perspective, Knight Frank Singapore’s research head, Leonard Tay, noted that thus far, the moderations in industrial rents and prices have been rather benign and are not expected to decrease by more than 5 per cent for the whole of 2020 despite the recession.

“With sustainable solutions and digital platforms becoming increasingly important and critical for businesses to adopt, demand for industrial spaces that cater to such uses is projected to expand once recovery from the pandemic becomes more certain.

“Given Singapore’s stability in the face of external headwinds, the city will continue to be a favourable destination for companies worldwide.”

By Kalpana Rashiwala, The Business Times/ 24-Oct-2020