GRADE A office rentals in the Central Business District (CBD) are generally expected to remain under pressure in 2021, say property consultants, as companies scale back on space amid economic headwinds.

According to JLL’s head of research & consultancy Tay Huey Ying, CBD Grade A office rents are expected to fall in 2021, although the decline could moderate to about half the 9.3 per cent pullback seen in 2020 as the economy gets back on track.

Chris Archibold, JLL’s head of leasing, expects there will be some firms reducing office space, as has been the case with past downturns.

Mr Archibold added: “Given that technology has given occupiers the ability to work remotely, the outcome could well be in excess of that seen during the Global Financial Crisis, though we are currently at around the same level.”

Executive director at Savills, Alan Cheong, expects headline rents for Grade A office space will likely decrease, with most tenants to cut space as leases come up for renewal.

Banks such as Japanese lender Mizuho Financial Group and Citigroup are already trimming office space – both are doing so at Asia Square – and other companies could follow suit when their leases expire. Amazon is poised to take over some of the space being vacated by Citi at Asia Square Tower 1 as the e-commerce giant is reportedly set to lease around 90,000 square feet across three floors.

“Some (office market players) may, in the interest of keeping headline rents stable, be open to venturing into structured deals,” Mr Cheong said, adding that it will be hard to ascertain the magnitude of headline decline as such structures may mask the effective rent.

In net cash flow terms, new leases signed or renewed could ease by an average of about 10 per cent year-on-year, he estimates.

And while some companies are keen to reduce their office footprint, this is not the case for all; some larger occupiers are maintaining their space, Mr Cheong added.

For instance, many banks would still need their frontline staff to return to the office.

According to CBRE Research, office rents in the Grade A core CBD market are already started to feel the impact of emerging vacancy. Rents dipped 2.8 per cent quarter-on-quarter to S$10.40 per square foot per month in the fourth quarter of 2020, which translates to a sharper 10 per cent drop for the full year, CBRE calculated.

In contrast, rents grew by 6.9 per cent in 2019, said CBRE, which expects occupancies for Grade A Core CBD space to see downward pressure in early 2021 despite the limited supply of new Grade A projects coming onstream.

Colliers International offers a more sanguine forecast, that CBD Grade A rents will climb 5.5 per cent in 2021 after retreating in 2020. Head of research Tricia Song outlined factors underpinning the 2021 outlook such as limited new office completions as well as space removed from the market as some older developments are rebuilt into mixed-developments; a recovering global economy prompting companies to expand their footprint; and growing demand from occupiers in the technology sector. Ms Song expects positive net absorption in 2021 as some hard-hit sectors scale back on space but sectors that are performing well expand.

Analysts expect the main drivers for office demand in 2021 to stem from firms in the tech, social media and fintech sectors.

For instance, Chinese firms ByteDance and Tencent have indicated that they are taking up office space in Singapore amid escalating geopolitical tensions with the United States.

Rick Thomas, Colliers’ executive director and head of occupier services, said: “The influx of occupiers from the tech sector will continue to drive demand and take-up, coupled with significant shifts in free trade agreements and the rise in digital banking licences (which) will accelerate growth.”

And while co-working operators – a key driver of new office space in recent years – might be more circumspect about expansion going forward, they are not expected to go anywhere anytime soon, thanks to the flexibility they offer companies. Flexible workspace operators may adopt a more cautious stance when it comes to growth and instead work on enhancing occupancy, especially for new locations, highlighted Ms Song.

Previously committed leases for co-working spaces set to open in 2021 include The Great Room at Afro-Asia i-Mark and The Work Project at CapitaSpring.

On the supply side, about 900,000 sq ft of CBD Grade A office space was completed in 2020, up from 100,000 sq ft in 2019, JLL estimates.

Among the notable projects in 2020 are 79 Robinson Road and 30 Raffles Place (formerly known as Chevron House), analysts said.

JLL’s Ms Tay projects that about one million sq ft of space will come onstream in 2021, from Afro Asia i-Mark, CapitaSpring and 21 Collyer Quay – less than the 10 year average annual new completion of 1.1 million sq ft.

In addition, more than half the total new supply for 2021 has been pre-committed, she pointed out, which should alleviate some of the downward pressure for rents.

Savills’ Mr Cheong highlighted that some buildings are expected to be taken off the market for redevelopment, such as AXA Tower and Fuji Xerox. While net effective rents could come down 10 per cent year-on-year in 2021, the decline could be cushioned if there is robust demand from displaced tenants as well as new-to-market companies, he reckons.

Meanwhile, JLL forecasts that the CBD Grade A office vacancy rate will maintain at about 6.5 per cent to 7 per cent over the next 12 months. As at end- 2020, the consultancy estimates the vacancy rate will stand at 6.8 per cent, up from 4.1 per cent as at end 2019.

Ms Song projects the vacancy rate for the CBD Grade A office market to clock 5.2 per cent for end-2020, before narrowing to 5 per cent at end-2021.

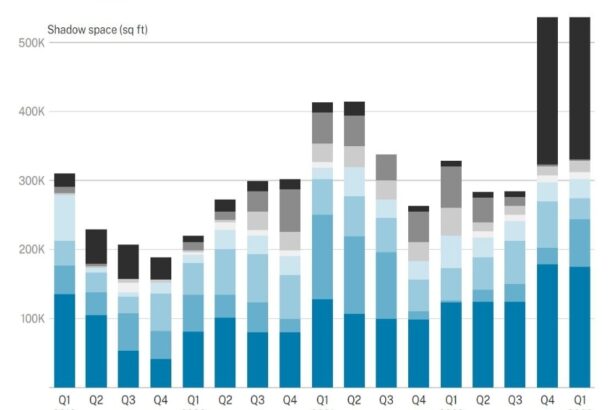

Where shadow space is concerned, there is about 900,000 sq ft of business space across Singapore that occupiers are looking to dispose of, according to Mr Archibold. This cuts across various industries, notably firms which have felt the full brunt of the pandemic, such as those in the hospitality and travel sectors. Shadow space refers to excess space on an existing lease obligation that a tenant would like to give up by finding a replacement tenant for the landlord.

“In any given market, there is always an element of space – about 150,000 sq ft – that occupiers are looking to dispose of for one reason or another,” added Mr Archibold.

Based on Urban Redevelopment Authority data, Singapore’s island-wide office market saw negative net absorption of about 871,875 sq ft in the first nine months of 2020. In contrast, 2019 saw positive net absorption of about 1.66 million sq ft.

URA’s island-wide office vacancy rate eased to 12 per cent at the end of the third quarter of Q3 from 12.1 per cent at the end of the second quarter of 2020; this is up from 10.5 per cent at the end of Q4 2019.

By Nisha Ramchandani, The Business Times/ 6-Jan-21